The Stratton Oakmont scandal remains a sensational narrative that shook the foundations of Wall Street, weaving tales of ambition, greed, deception, and eventual justice that changed the financial industry forever. From its audacious beginnings through its illicit practices to its infamous demise, the saga of Stratton Oakmont is a cautionary tale of how far some will go for success. This powerful brokerage firm, founded by Jordan Belfort and Danny Porush, became emblematic of the abuses that plagued finance in the 1990s, generating controversies that continue to resonate today.

7 Key Events in the Stratton Oakmont Scandal That Altered Wall Street Forever

Here we delve into the seven pivotal events that encapsulate the rise and fall of Stratton Oakmont, illuminating the firm’s impact on both finance and popular culture.

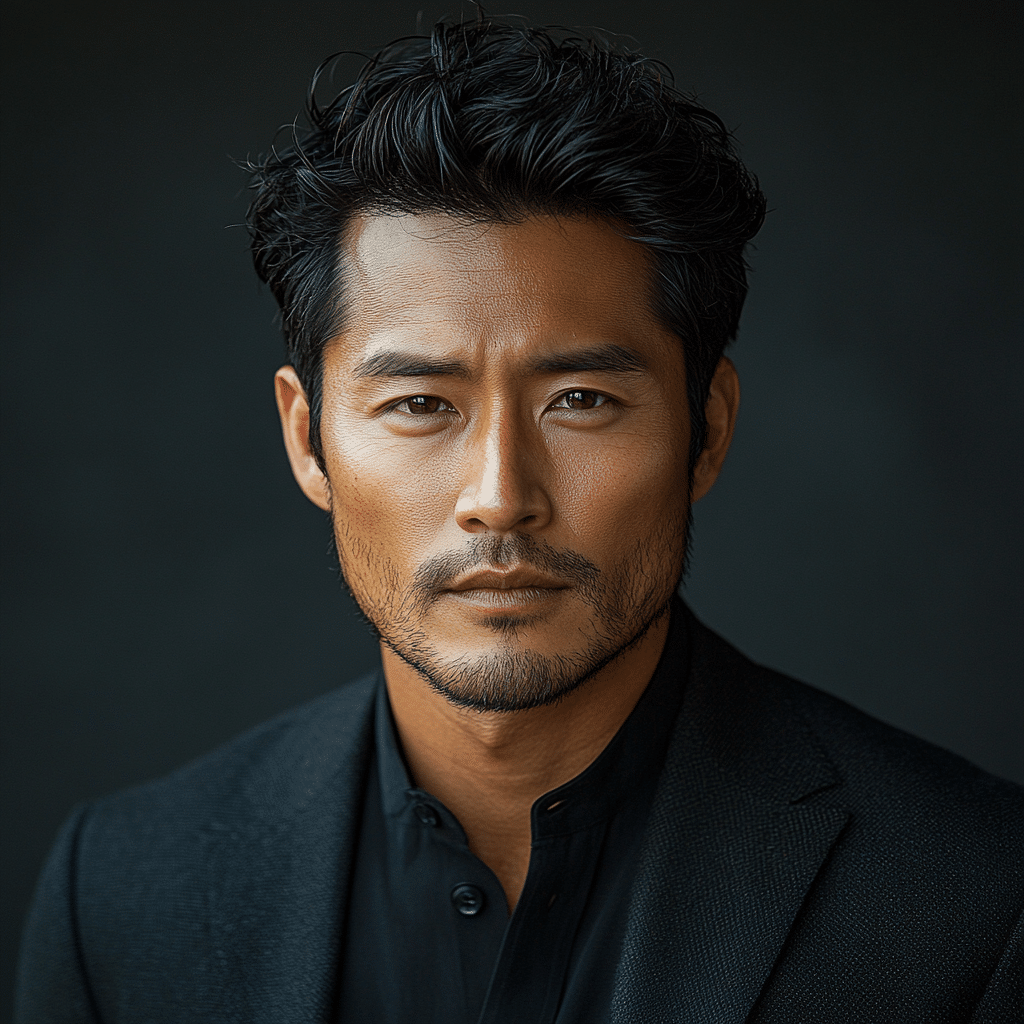

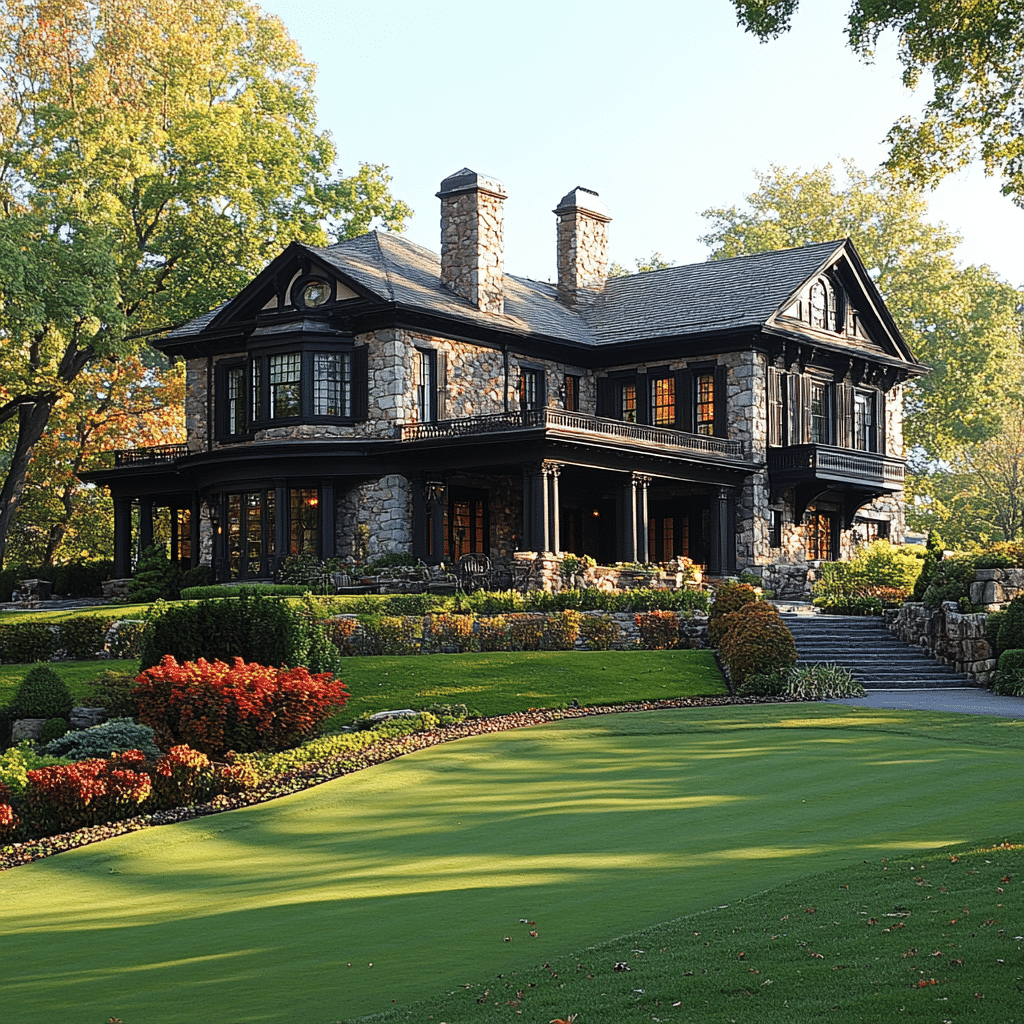

1. The Rise of Stratton Oakmont: A Brokerage Built on the Edge

In the late 1980s, Jordan Belfort and Danny Porush established Stratton Oakmont, aiming for the sky in the high-stakes world of finance. With charismatic teams of brokers working aggressively, the firm pushed the envelope of ethical sales practices. By focusing on penny stocks and using manipulative sales tactics, they attracted investors with promises of eye-popping returns, becoming a springboard for the lavish lifestyles portrayed in films like The Wolf of Wall Street. Strikingly, they wrapped their actions in the allure of success, hiding their unethical methods behind a thick veil of charm.

2. The Pump and Dump Scheme: Manipulating Stock Prices

Stratton Oakmont’s hallmark strategy was the notorious “pump and dump” scheme. This involved generating hype around specific stocks to artificially inflate their prices through misleading promotions and fabricated tales. Once the price reached a lucrative peak, the brokers would sell off their shares, leaving everyday investors holding worthless stocks. With cold calling as their primary weapon, many unsuspecting consumers fell victim to these deceitful practices, which sparked outrage and concern regarding the ethics of finance.

3. SEC Investigations: The Tipping Point

In the mid-1990s, the SEC turned its spotlight on Stratton Oakmont, initiating investigations following numerous complaints from deceived investors. These inquiries uncovered a shocking extent of securities fraud and blatant market manipulation. The relentless pursuit of accountability by the SEC marked a significant turning point—not just for the firm but for Wall Street as a whole—highlighting systemic issues in regulatory oversight that allowed such malpractice to flourish unchecked.

4. The 1999 SEC Settlement: A Temporary Halt

In 1999, the SEC managed to strike a major blow against Stratton Oakmont by forcing the firm into a settlement where they paid substantial fines. This act ended their operations as a legitimate brokerage firm, but it did little to mend the damage inflicted upon investors who’d lost their savings in the ensuing chaos. While the settlement felt like a small victory for regulation, it served as a glaring reminder of the deficiencies in monitoring and compliance that plagued Wall Street during this era.

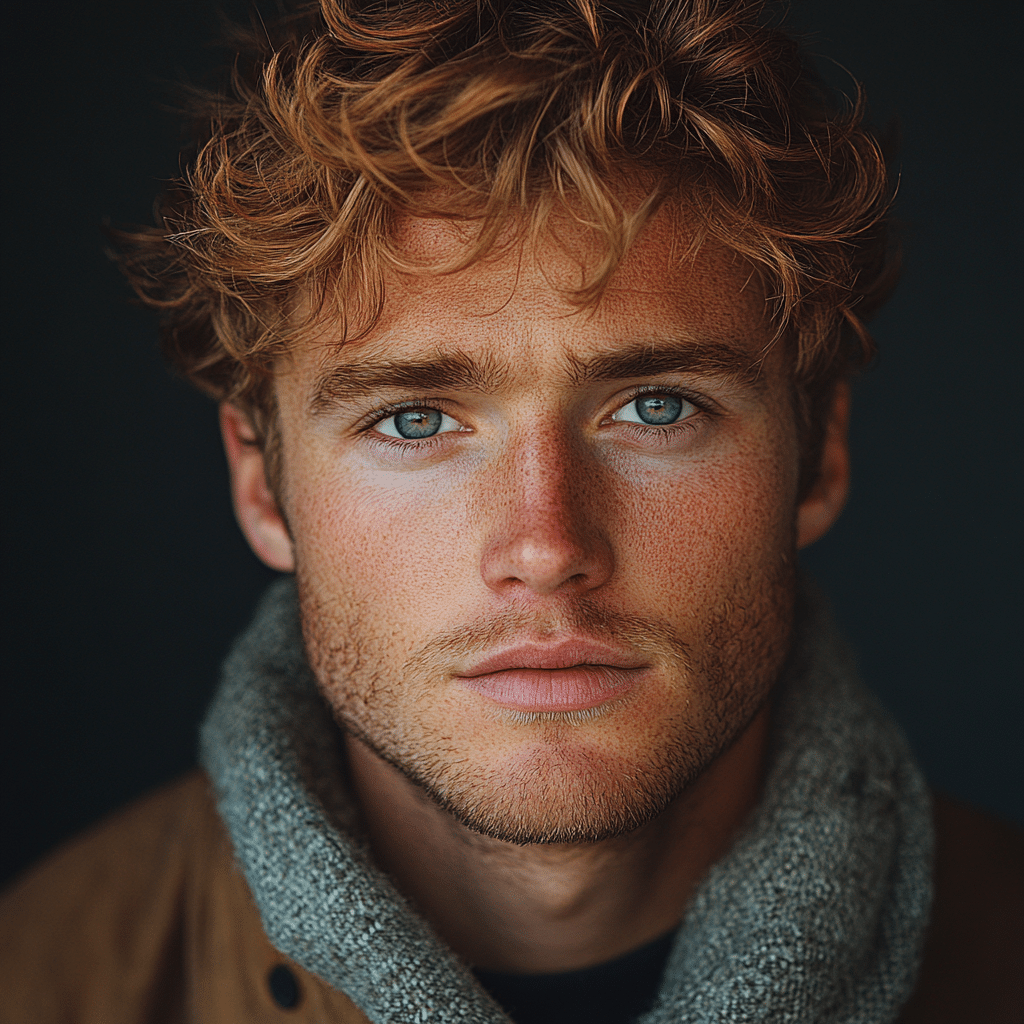

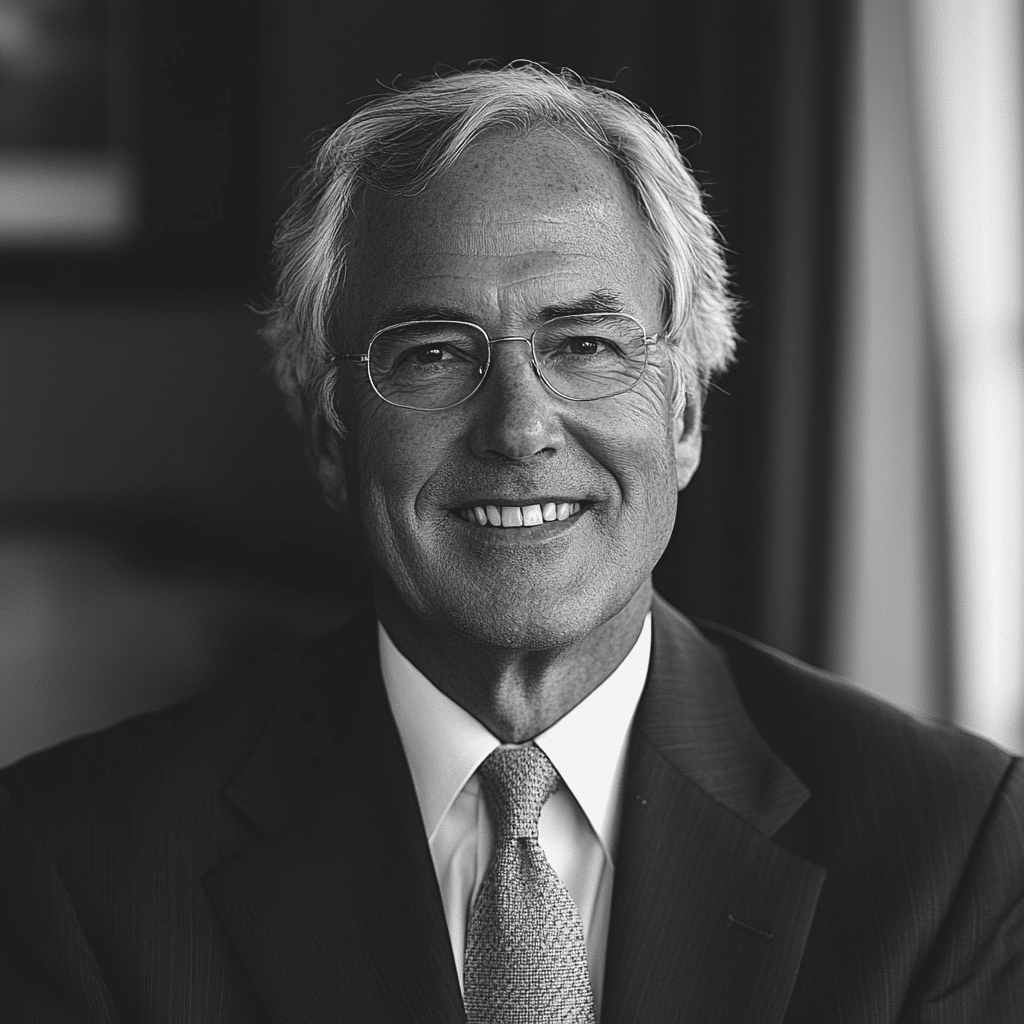

5. Jordan Belfort’s Downfall: From Broker to Convicted Felon

Jordan Belfort’s story is the quintessential tale of a meteoric rise followed by a harrowing fall. In 2004, a federal courtroom sentenced him to four years in prison for securities fraud and money laundering. Once celebrated as a star broker, Belfort’s disgrace became a rallying point—an example of what unchecked ambition can lead to. His journey transformed him into a cautionary icon in finance, sparking discussions about ethics and integrity within the industry.

6. The Cultural Impact: Movies and Media Reflecting Scandal

As the dust settled on the Stratton Oakmont scandal, its impact rippled through popular culture, sparking narratives that critiqued the financial system. Martin Scorsese’s blockbuster film The Wolf of Wall Street, released in 2013, brought renewed attention to this sordid chapter, blending extravagant storytelling with a harsh commentary on the darker side of ambition and morality in finance. The film ignited conversations about the glamorization of white-collar crime, prompting the audience to confront the moral hazards present in a system driven by greed.

7. Lessons Learned: Laying the Groundwork for Financial Reform

The aftermath of the Stratton Oakmont scandal revealed an urgent need for reform within financial regulations. In response, the SEC and various regulatory bodies began overhauling their frameworks, emphasizing stricter compliance measures and investor protections to prevent the recurrence of such events. These changes, intended to foster a more accountable financial ecosystem, underscore the lessons learned from the firm’s audacious games played on the investment playground.

Transforming Wall Street: The Enduring Legacy of Stratton Oakmont

The Stratton Oakmont scandal serves as a timeless reminder of the perils of ambition unchecked by ethics. Its legacy influences ongoing dialogues about investor protection, ethical conduct, and the responsibilities of financial institutions. As new scandals and controversies emerge in the financial world, the lessons from Stratton Oakmont resonate like cautionary whispers through the bustling halls of investment firms today. Continued vigilance, integrity, and accountability will be essential in shaping the future of finance, ensuring that the mistakes of the past aren’t repeated.

In wrapping up, the Stratton Oakmont saga isn’t just a story about a brokerage firm’s downfall; it’s a lens through which we can examine the larger dynamics of ambition, ethics, and the consequences of deception in finance. The narrative amplifies the urgent need for reforms and serves to remind us about the fine line between success and excess, a theme that rings as true today as it did back in the 1990s. So, as we look onto the ever-changing landscape of our economy, let’s honor the lessons of Stratton Oakmont and strive for a finance world that promotes fairness over fraud.

The Stratton Oakmont Scandal: Intriguing Trivia and Facts

Wall Street’s Wild Ride

The Stratton Oakmont scandal was a whirlwind that brought some seriously unusual stories to light. This brokerage firm became infamous for their involvement in pump-and-dump schemes that defrauded investors out of millions. You might be surprised to learn that, during the early 2000s, the firm was under scrutiny as the nation was also grappling with issues related to national security. Looking back, it’s fascinating how both Wall Street and broader societal concerns intersected during that tumultuous time. While many recall the drama around figureheads like Jordan Belfort, few delve into how the scandal impacted the financial landscape, highlighted in various documentaries and discussions about scandals like it, including the Riley Lewis case.

The Characters Behind the Controversy

Stratton Oakmont was home to a cast of characters as colorful as any Hollywood production. Besides Belfort, you had a slew of personalities such as Misty Mcmichael, who became a media sensation due to her ties to the chaotic environment. The ties to celebrity culture didn’t end there; fascinatingly, the firm was known not just for finance but also for its wild parties, sometimes resembling scenes straight from step-up 2 cast parties on the silver screen. It’s a wonder how this operation attracted attention not just from investors, but also from those seeking a glimpse at the glitz and the grit of Wall Street’s underbelly.

Lasting Impact and Lesser-Known Facts

Even after the downfall of Stratton Oakmont, its influence lingered, notably in how regulations evolved in the finance sector. The tale serves as a cautionary reminder against fraud, underlining the importance of understanding liability in addiction and gambling—a concept often overlooked by many. In terms of culture, Stratton Oakmont left its mark on films, inspiring characters and narratives that echo through cinema, much like the emotional storytelling found in the Super Man: The Christopher Reeve Story showtimes. Interestingly, several people associated with the scandal, including Tim Mckyer, have shared their stories, shedding light on the chaotic environment and providing insight into lessons learned along the way. The fallout from this scandal continues to inspire discussions about ethics in business and finance today.