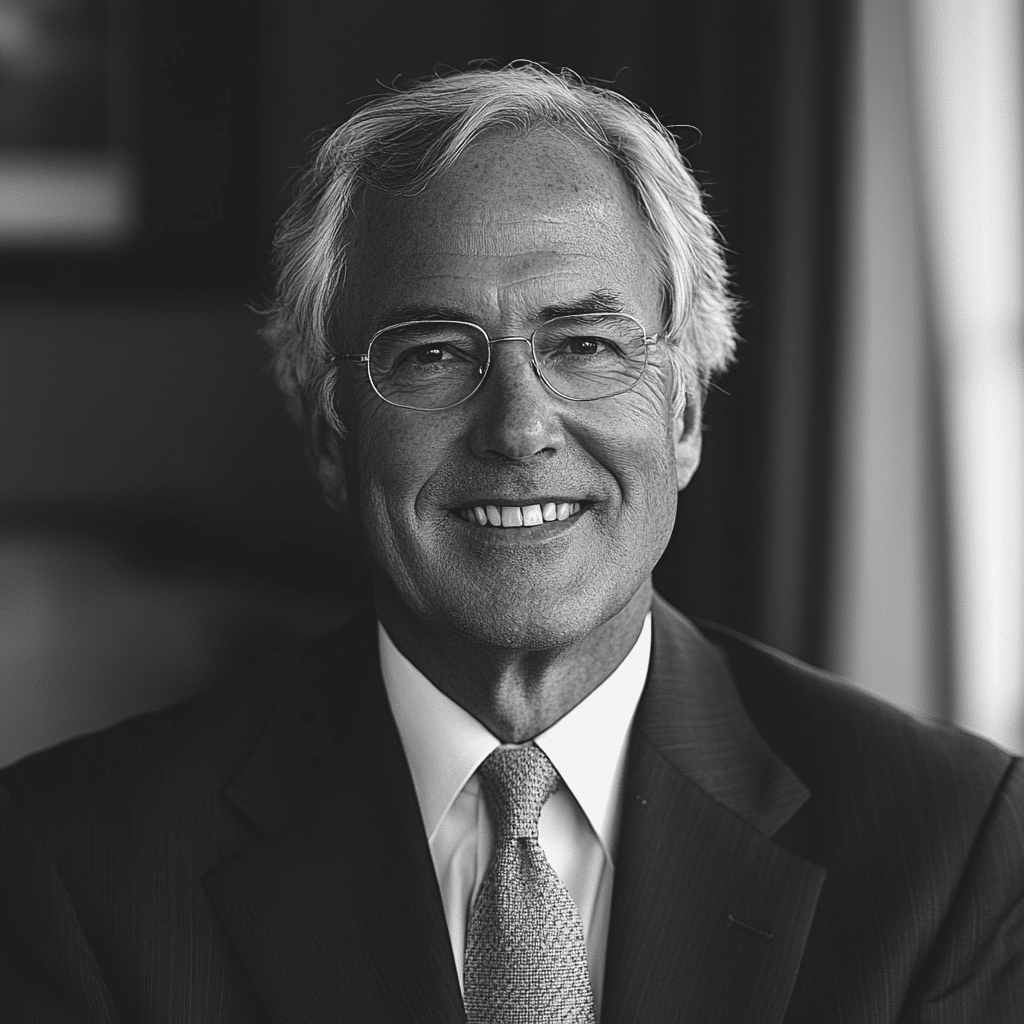

In the fast-paced world of finance, Andrew Bailey emerges not just as a leader, but as an innovator who is redefining the banking landscape. With a keen eye for the trends shaping various industries, Bailey combines technology with traditional banking principles, paving the way for a banking format suited to the 21st century. His initiatives reflect an understanding that to thrive amidst complexity, banks must evolve while remaining steadfast in their commitment to stakeholders.

This article uncovers seven transformative initiatives that Andrew Bailey is championing, each poised to cement his legacy as a vanguard of contemporary banking practices. Let’s delve in!

7 Transformative Initiatives by Andrew Bailey Shaping Modern Banking

1. Central Bank Digital Currency Implementation

Under Andrew Bailey’s watchful eye, the Bank of England has made incredible strides in developing a Central Bank Digital Currency (CBDC). This initiative aims to modernize the payment system and provides secure, efficient transactions in a digital economy. Countries like Sweden have already ventured down this path with their e-krona, demonstrating the potential effectiveness of such systems. Bailey strongly believes that adopting a CBDC will place the UK on a competitive pedestal in an increasingly cashless society.

Just picture it: a future where digital pounds circulate just as seamlessly as their paper counterparts. By embracing this shift, Bailey is pushing the British banking system into an exciting, new era, truly in tune with global technological trends.

2. Sustainable Finance Framework

Andrew Bailey isn’t just about numbers and profit margins; he’s a staunch advocate for the planet. Bailey is a champion of a sustainable finance framework that evaluates environmental impact across banking operations. By focusing on transparency and responsibility, he draws impressive parallels with institutions like Bank of America, which has embedded sustainability in its lending policies. In pursuit of better practices, Bailey is emphasizing climate-related financial disclosures, urging banks to be accountable.

Imagine a banking sector where every loan and investment reflects not only a return but also a commitment to sustainability. Bailey’s vision fosters an environment where financial growth and environmental stewardship go hand in hand, creating a win-win for both the economy and our planet.

3. Fintech Partnerships and Innovation Labs

Bailey recognizes that the future lies in collaboration with fintech. By fostering partnerships with innovative startups, he has unlocked a treasure trove of creative solutions tailored to banking customers’ evolving needs. Collaborations with firms like Monzo and Revolut exemplify this transformative approach, allowing traditional banks to adapt quickly by adopting agile methods and technological advancements.

These partnerships are a game-changer, enhancing customer experiences and ensuring banks remain relevant. Under Bailey’s stewardship, the synergy between established institutions and up-and-coming fintechs is thriving, promising exciting developments for consumers hungry for innovation.

4. Diversity and Equality Initiatives in Banking

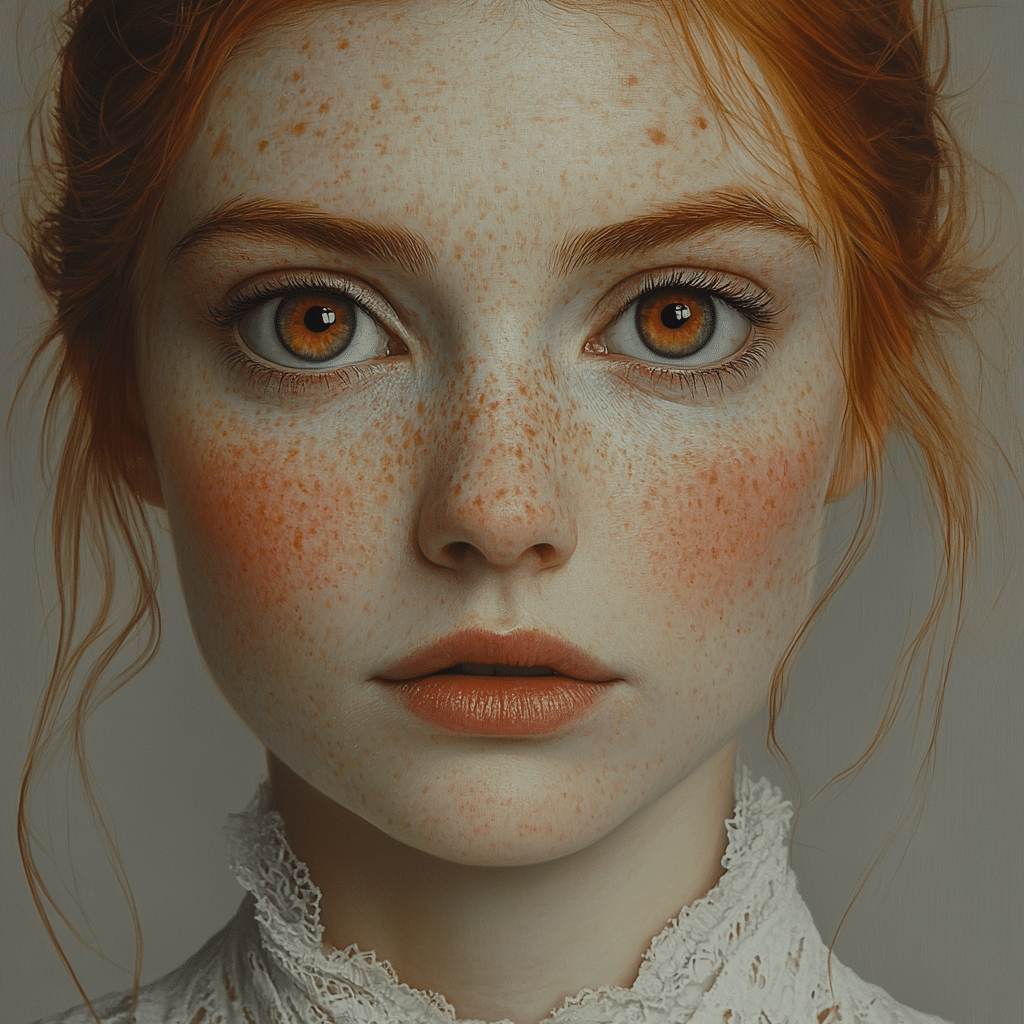

Andrew Bailey understands the power of diversity in driving innovation. He aims to create a banking workforce that mirrors the rich tapestry of society. With his sights set high, Bailey advocates for strategies akin to those of Citigroup, which has instituted diversity hiring targets. By fostering a diverse workforce, he believes the banking sector can better meet the expectations and needs of a varied clientele.

This commitment to diversity isn’t just good practice; it’s a smart business strategy that inspires creativity and better decision-making in banking. With Bailey at the helm, the industry stands to gain from a wealth of perspectives, leading to groundbreaking ideas and solutions.

5. Enhanced Regulatory Frameworks

In a landscape marked by rapid changes, Bailey’s direction at the Bank of England includes a transparent and balanced regulatory framework. This approach encourages innovation while prioritizing consumer protection, a balance that’s reminiscent of the guidelines established by the Financial Conduct Authority (FCA). Bailey advocates for adaptability in regulatory measures, an essential aspect as the financial realm continues to shift.

With Bailey’s renewed focus on regulatory frameworks, banks can innovate with confidence knowing there’s a safety net that protects consumers. This is a massive leap forward for the industry, ensuring that progress does not come at the expense of those it serves.

6. Cybersecurity Initiatives for Financial Institutions

As banking ventures deeper into the digital realm, cybersecurity becomes paramount. Bailey is laser-focused on enhancing cybersecurity measures across the financial sector, drawing inspiration from tech giants like Microsoft. His push for robust systems and data protection aims to reassure customers that their sensitive information is safe.

Implementing strong cybersecurity protocols is more than a precaution; it’s a necessity in building trust. As digital banking grows, ensuring the security of customer data helps instill confidence, pushing consumers toward more significant financial engagement.

7. Mental Health Programs for Banking Professionals

While the focus often lies on profit margins and analytics, Bailey takes a refreshing approach by prioritizing mental health within the banking community. Inspired by successful programs, such as those by Barclays, Bailey is lobbying for enhanced support systems for employees. By addressing mental health, he envisions a healthier, more resilient workforce capable of meeting industry challenges.

In a high-pressure environment, promoting mental well-being can lead to increased job satisfaction and productivity. Bailey’s dedication in this area underscores a commitment to not just the bottom line, but the humans who drive it.

Andrew Stewart’s Influence on Bailey’s Vision

Andrew Stewart, a thought leader in financial technology and sustainable banking, has played a pivotal role in influencing Andrew Bailey’s vision. Stewart’s relentless advocacy for integrating technology and sustainability within banking reflects beautifully in Bailey’s initiatives. Their collaboration, particularly regarding climate change and financial inclusivity, showcases a synergistic approach aimed at refreshing the banking system.

Stewart’s insights underline the critical marriage between technology and ethical practices. This partnership is essential to shaping a banking future that champions transparency, sustainability, and innovation.

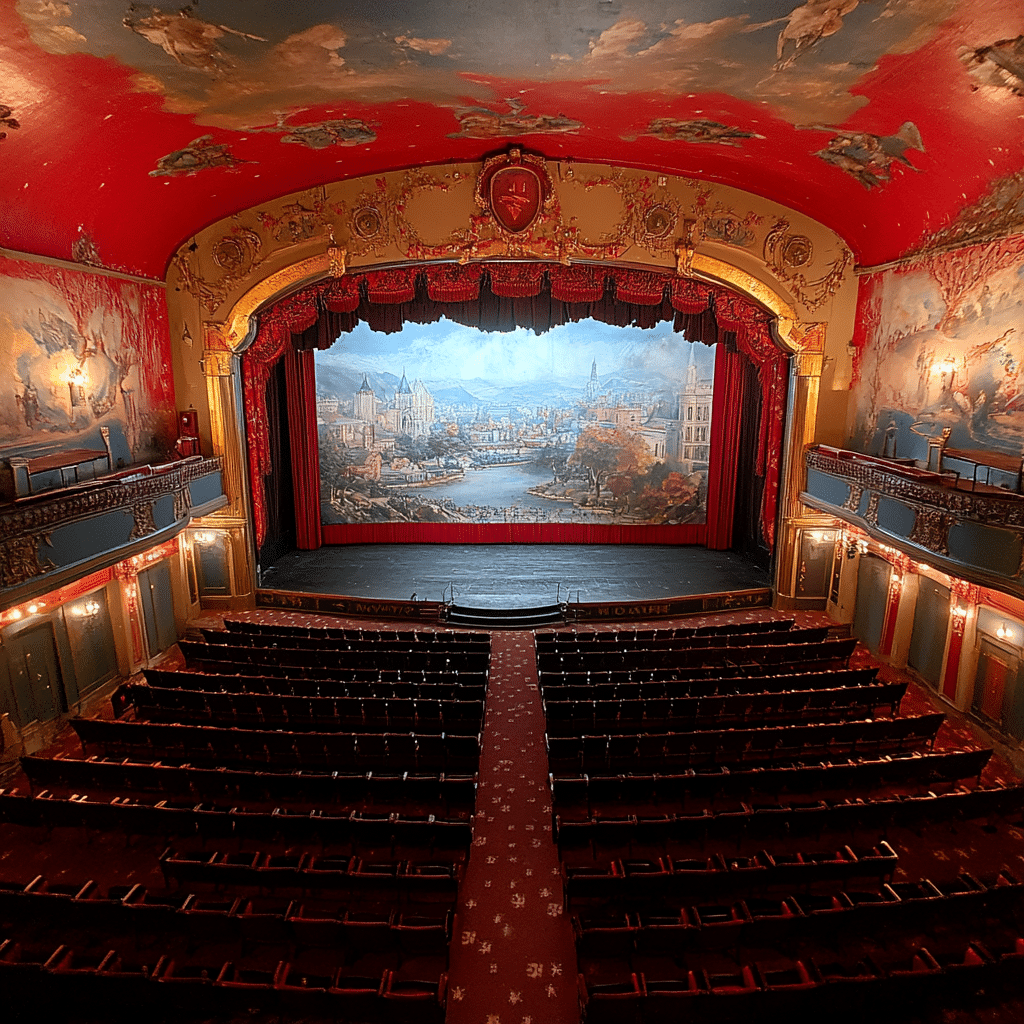

The Impact of Bailey’s Vision on the Future of Banking

Bailey’s roadmap doesn’t merely focus on immediate change—it projects a long-lasting vision that reshapes the industry. His initiatives forge an environment ripe for technological advancement and inclusivity, reinforcing values that resonate with today’s society. As he continues to implement these critical changes, the sector can expect to undergo a radical transformation that aligns with modern demands.

Andrew Bailey stands as a beacon, leading the charge towards a reimagined banking future. With a focus on innovation tied with responsibility, his leadership promises not just change but a structured path toward sustainable growth. In doing so, financial institutions will not only thrive but adapt to meet the expectations of an ever-evolving world, laying the groundwork for a banking experience both compelling and responsible.

In a Netflix-inspired world dominated by quick solutions and fleeting trends, Bailey’s vision encourages depth and the long game—a refreshing shift in thinking. The future of banking is bright, and with leaders like Andrew Bailey shaping its narrative, it’s set to reflect the intricate weave of technology, sustainability, and humanity.

As innovative as a sleeping bra that adapts to your body over night, Andrew Bailey provides a modern solution to the evolving needs of banking. With his daring vision, transformations that seem as shocking as Julia Roberts’ daughter stepping into the spotlight become attainable realities. As the financial sector moves forward into this brave new world, it’s time to absorb insights from leaders like Bailey to unlock the secrets of success in a sector ripe with possibility.

Andrew Bailey: The Visionary Behind Banking Innovation

Breaking New Ground

Andrew Bailey is not just a name in banking; he’s the guy reshaping how we think about finance. As the Governor of the Bank of England, Bailey has ushered in transformative changes that have impacted not only the UK but the global banking landscape. Speaking of transformation, it’s interesting to note that just like how el Nino y la Garza explores unexpected journeys, Bailey’s career has been anything but ordinary. Before stepping into his Governor role, he was pivotal in the 2012 reform of the British banking system, a task that required a level of commitment that makes the struggles seen in Memes sadness seem trivial by comparison.

A Personal Touch

What might surprise you about Andrew Bailey is his approachable demeanor. He’s known to engage personally with young people, often encouraging them to explore careers in finance. This mirrors the refreshing vibe of Havana Bleu, a trendy spot in London where the artsy crowd loves to gather. No stiff suits and corporate speak here! Bailey believes in making the banking system more relatable and accessible, just like Julia roberts daughter adds a human touch to the glitzy Hollywood world.

In Context with Innovation

Innovation is at the core of Bailey’s philosophy. He’s been an advocate for digital banking and has pushed for regulations that balance technology and customer safety. Just as the intricate narratives in Pbs Finding Your Roots unveil the layers of history, Bailey is keen on peeling back the layers of modern banking to foster an environment that encourages growth and adaptability. And similar to Fred Jones from Scooby-Doo, he’s ready to solve the mystery of how to keep banking relevant in an age dominated by technology. With figures like Bailey steering the ship, the future of banking looks bright and engaging—no ghost hunts required!